Development Trends and Overseas Application Prospects of Mining Electrification Equipment

With the global mining industry transitioning towards intelligence and green development, mining electrification equipment is facing dual opportunities of technological innovation and market expansion. This article will analyze from three dimensions: technological development trends, energy-saving benefits, and overseas market applications.

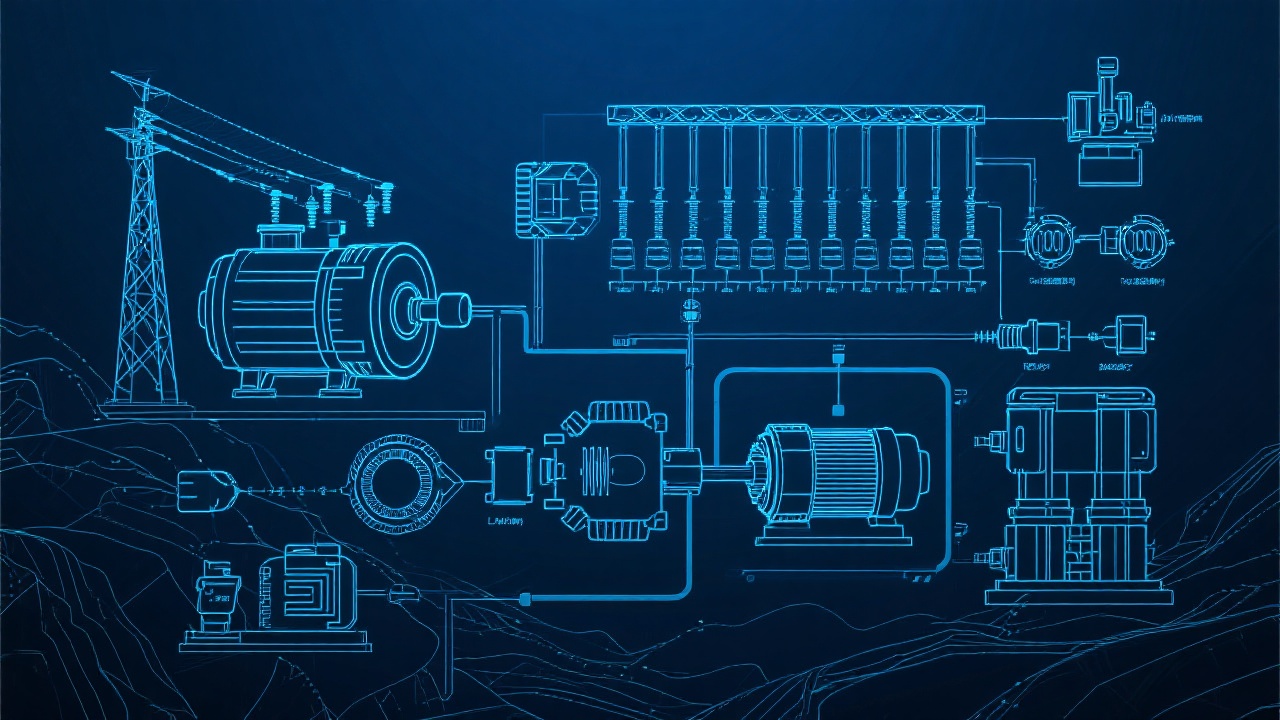

I. Technological Development Trends

1. High-efficiency motor systems: New permanent magnet synchronous motors can improve efficiency by 15%-20% compared to traditional equipment, and can dynamically match load requirements with variable frequency speed regulation technology. A case study from an open-pit mine shows that after retrofitting with electric drive systems, single-unit annual electricity savings reached 450,000 kWh.

2. Intelligent power distribution networks: Modular substations and digital twin technology enable real-time monitoring of power quality. A Canadian copper mine project reduced line losses by 12% through intelligent power distribution systems.

3. Regenerative braking technology: Underground transport vehicle braking energy recovery systems can convert 20%-30% of kinetic energy into electricity. A South African platinum mine reduced auxiliary power demand by 18% after adopting this technology.

II. Energy-saving Benefit Analysis

1. Efficiency comparison: Electrified equipment improves energy utilization rate by 40%-60% compared to diesel power systems. Data from a Chilean copper company shows that electric mining trucks reduced total lifecycle operating costs by 32%.

2. Emission reduction: Each electric rock drill can reduce CO2 emissions by 80 tons annually, equivalent to the carbon sequestration capacity of 5 hectares of forest. Australia's BHP plans to complete full electrification of mining areas by 2030.

3. Cost structure: Although initial investment increases by 15%-25%, the incremental costs can be recovered through electricity savings in 5-7 years. A TCO analysis of a cobalt mine in the Democratic Republic of Congo confirms this economic model.

III. Overseas Market Expansion

1. European and American markets: Greater focus on equipment carbon footprint certification, requiring compliance with ISO 50001 standards. Sweden's LKAB procurement clauses mandate suppliers to provide full lifecycle emission data.

2. Latin America: Countries like Chile and Peru offer 15%-20% purchase tax exemptions to promote replacement of old equipment with electrified alternatives. Peru's mining electrification rate reached 28% in 2024.

3. African markets: Strong demand for off-grid PV-storage-electrification integrated solutions. A Zambian copper mine project reduced diesel consumption by 76% after adopting this model.

The current technology iteration cycle has shortened to 3-5 years. Companies are advised to focus on solid-state batteries and wireless charging technologies while establishing localized service networks to meet different markets' compliance requirements.